What are Zero-Coupon Bonds

Zero-coupon bonds, which are also known as discount bonds, are bonds that are purchased at a discounted price and do not pay interest periodically but render a profit at maturity when the bond is redeemed for its full face value.

This means that zero-coupon bonds are bonds sold at a significant discount to their face value and do not pay interest regularly, instead, investors must invest a lump sum at the start of their investment and receive a larger lump sum at the end of their investment.

However, this brings us to the question, what makes an investor purchase a zero-coupon bond, and why is it in high demand?

The reason is that, apart from being sold at significantly lower prices, this bond is a useful financial plan for investors who intend to save money for a short or longer period. While doing this, You can invest a sum of money right now that will eventually mature into a bigger lump sum at a later stage.

For example, a bond with a face value of $10,000 will sell for less than its face value at a price of $7,500. While the investor will not receive any interest periodically, upon maturity, he will receive the full face value of the bond. Profit=$10,000-$7,500=$2,500 (Numbers are meant purely as examples).

Holders of zero-coupon bonds must understand that the maturity date of any bond depends on whether it is a short-term or long-term investment. BILLS are short-term zero-coupon bonds that typically mature within a year. CDs, which are long-term zero-coupon investments, typically mature in 10 to 15 years. As a result, they are ideal for retirement savings and college education financing.

Advantages Of Zero-Coupon Bonds

- Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over an extended period, the perceived risk is higher. As a result, companies have to pay investors a higher rate of return to compensate the investors for taking higher risks. This is the reason why zero-coupon bonds have a higher annualized yield as compared to other bonds. This works out to be beneficial for investors who do not need to receive immediate payments.

- No Reinvestment Risk: considering the annualization rate of Zero-coupon bonds, investors do not receive any cash flow which they have to reinvest periodically. The annualized rate they receive on the zero-coupon bond is the same rate at which their money will be automatically reinvested. This is why zero-coupon bonds become extremely popular, especially when the market yield is high. This is because investors want to lock this high yield over extended periods.

- Liquidity is high: Zero-coupon bonds have a very liquid market. This means that there are a lot of individual investors as well as institutions that are constantly buying and selling zero-coupon bonds. As a result, investors can do so without facing any loss in value when they want to sell their bonds. High liquidity means investors do not have to wait until maturity to reap their gains. They can sell the bonds anytime to obtain their principal and accrued interest.

- Perfect Financial Plan For Investors: This bond is useful for investors planning for their kids’ education or marriage because they can invest a sum of money right now which will eventually mature into a more significant lump sum later. This fits into the individual financial plan of many investors.

Disadvantages Of Zero-Coupon Bonds

The advantages of zero-coupon bonds are widely publicized and known, but this does not undermine some of their significant disadvantages. Below is a list of a few of them:

- Taxation: Zero-coupon bonds do not pay any interest to investors periodically. Instead, the interest does accrue over the years and is paid on maturity dates. However, on top of that, governments do not want to wait to receive their share of taxes. Hence, most governments worldwide will charge tax immediately based on the amount of interest accrued.

- Risky: Businesses that issue zero-coupon bonds are not required to pay recurring interest on their investments. This frequently indicates that these businesses favour taking on greater investment risk. Additionally, because the bonds must be repaid over an extended period, there is a significant risk that the company won’t endure.

- Irregularity in Cashflow: Zero-coupon bonds do not offer any fixed cash flows, which brings us to our final point. This implies that a sizable portion of investors in fixed-income securities who make investments to receive monthly income are shut out of the market.

Standard Terms Used In Calculating Zero Coupons

- PV = Price Value

- FV = Future Value

- YTM = Yield-to-Maturity (YTM)

- t = Number of Compounding Periods

- R= rate of returns or interest rate

- M= Date of maturity

- N = Number of Years until Maturity

How to calculate Zero-Coupon Bonds

The formula for calculating the present value of a zero coupon bond: P^(1-YTM)=FV

For instance: You buy a one year zero coupon bond for $95,238 and the face value of the bond is $100,000. Note that because it is zero coupon bond, you will not earn any periodically interest payment. Instead upon maturity, the difference between the face value of the bond which is $100,000 and the $95,238 is considered the interest you have earned .

Answer: Face value: $100,000.

Present value: $95,238

N: Number of years : 1year.

P^(1-YTM)=FV

$95,238 ^(1+YTM)= $100,000.

1+ YTM= 100,000/95,238

1+ YTM= 1.05

YTM= 1.05 -1 = .05

YTM = 5%.

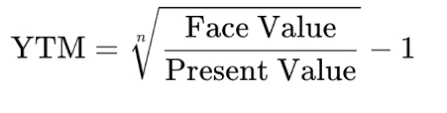

Note that the above formula works perfectly when you wish to calculate the Yield-to-Maturity (YTM) for a period of 1- 2 years. However, should the number of years of a bond be 3 years, and above, you can use the formula below.

YTM=(FV/P)1/n-1

N= 3 years

Face value: $100,000.

Price value: $95,238

Answer: YTM=(100,000/95,238)1/3-1

YTM=.016 to percent 1.6%

Third example; You buy a Five years zero coupon bond for $800 and the face value of the bond is $1000

P: $800

FV: $1000

N: 5 years

YTM= (N√FV)/P-1

YTM=(5√1000)/800-1

YTM= 0.0456 in decimal

YMT in percentage is equivalent to 4.56%.

READ ALSO: What are Government bonds: how you can invest your money in them

What Is The Difference Between A Zero-Coupon Bonds And A Regular Bonds?

| Zero Coupon Bond | Regular Bonds | |

| 1 | zero-coupon bonds do not issue such interest payments (otherwise known as coupons) | Regular bonds pay bondholders interest payments throughout the lives of the bonds |

| 2 | zero-coupon bondholders merely receive the face value of the bond when it reaches maturity | While regular bondholders receive both the face value, while also receiving coupons over the life of the bond. |

| 3 | zero coupon bonds are sold at lower prices or deep discounts | Regular bonds are not sold out at a deep discount. |

Pingback: Investment And Non-Investment Grade Bonds - Xeno Finance