Introduction

Before discussing the Three Soldiers and Crows, we will talk again about candlesticks and reiterate their importance in trading. Candlestick charts are an essential tool for traders to analyze price movements in financial markets. The use of candlestick charts is widely accepted and is considered one of the oldest methods of technical analysis in the financial market.

Candlestick charts present a graphical representation of the price movements of a financial asset over time. The shapes of the candlesticks give clues about the trend and provide insights into the psychology of the market participants. Interpreting candlestick patterns is essential for traders to identify trend reversal and continuation signals.

Definition of Three Soldiers

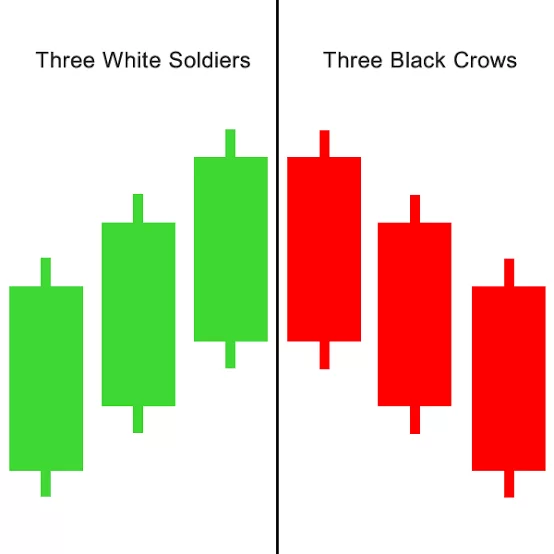

The Three Soldiers is a bullish reversal pattern that forms after a downtrend. It is a three-candlestick pattern in which three long bullish candles follow each other, each closing higher than the previous one. The pattern is a strong indication that the bulls have taken control of the market, and a trend reversal is likely to occur.

Characteristics of Three Soldiers Pattern

- The Three Soldiers pattern has the following characteristics:

- The pattern consists of three long bullish candles.

- Each bullish candle closes higher than the previous one.

- The pattern forms after a downtrend.

- The pattern indicates a trend reversal and a bullish trend.

Interpretation of Three Soldiers Pattern

The Three Soldiers pattern is a strong bullish reversal pattern that indicates a downtrend’s end and a new uptrend’s beginning. The pattern suggests that the bulls have taken control of the market and that the bears are losing their grip. The pattern is considered reliable when it forms after a prolonged downtrend, and the candles are long and strong.

Trading strategies using Three Soldiers Pattern

- Traders use the Three Soldiers pattern to identify a bullish trend reversal and take long positions in the market. The stop-loss can be placed below the low of the pattern, and the take-profit can be set at a distance equal to the pattern’s height.

- The Three Soldiers pattern can also be used as a confirmation of other technical indicators, such as moving averages, to increase the probability of a successful trade.

Definition of Three Crows

The Three Crows is a bearish reversal pattern that forms after an uptrend. It is a three-candlestick pattern in which three long bearish candles follow each other, each closing lower than the previous one. The pattern strongly indicates that the bears have taken control of the market, and a trend reversal is likely to occur.

Characteristics of Three Crows Pattern

The Three Crows pattern has the following characteristics:

- The pattern consists of three long bearish candles.

- Each bearish candle closes lower than the previous one.

- The pattern forms after an uptrend.

- The pattern indicates a trend reversal and a bearish trend.

Interpretation of Three Crows Pattern

The Three Crows pattern is a strong bearish reversal pattern that indicates an uptrend’s end and a new downtrend’s beginning. The pattern suggests that the bears have taken control of the market and that the bulls are losing their grip. The pattern is considered reliable when it forms after a prolonged uptrend, and the candles are long and strong.

Trading strategies using Three Crows Pattern

Traders use the Three Crows pattern to identify a bearish trend reversal and take short positions in the market. The stop-loss can be placed above the high of the pattern, and the take-profit can be set at a distance equal to the pattern’s height. The Three Crows pattern can also be used as a confirmation of other technical indicators, such as moving averages, to increase the probability of a successful

Similarities between three soldiers and crows

Despite being opposite in terms of their bullish or bearish nature, there are some similarities between the Three Soldiers and Three Crows patterns:

- Both patterns consist of three candles: The Three Soldiers and Three Crows patterns are both composed of three consecutive candles that follow each other.

- Both patterns represent a trend reversal: The Three Soldiers pattern represents a bullish reversal, while the Three Crows pattern represents a bearish reversal. In both cases, the pattern signals the end of the previous trend and the beginning of a new trend in the opposite direction.

- Both patterns require confirmation: Although both patterns are strong indications of a trend reversal, traders should look for additional confirmation before entering into a trade. Traders can use other technical indicators such as moving averages, trendlines, and volume to confirm the pattern.

- Both patterns are more reliable when they appear after a prolonged trend: The reliability of both patterns increases when they appear after a prolonged trend in the same direction. This indicates that the trend has lost its momentum, and a reversal is likely to occur.

Differences between Three Soldiers and Crows

- Direction: The primary difference between the two patterns is their direction. The Three Soldiers pattern is a bullish reversal pattern, while the Three Crows pattern is a bearish reversal pattern.

- Candlestick color: The Three Soldiers pattern consists of three long bullish candles, while the Three Crows pattern consists of three long bearish candles. The color of the candles is opposite in the two patterns.

- Timeframe: The timeframe of the two patterns can vary. While the Three Soldiers pattern can occur on any timeframe, the Three Crows pattern is more reliable on longer timeframes, such as daily or weekly charts.

- Strength: The Three Soldiers pattern is considered a stronger bullish reversal pattern compared to the Three Crows pattern, which is considered a weaker bearish reversal pattern. This is due to the fact that the Three Soldiers pattern occurs after a prolonged downtrend, while the Three Crows pattern occurs after a prolonged uptrend.

Conclusion

Triple candlestick patterns such as the Three Soldiers and Three Crows are important tools for traders to identify trend reversal signals. The Three Soldiers pattern is a bullish reversal pattern, while the Three Crows pattern is a bearish reversal pattern.

Both patterns are composed of three candles, require confirmation, and are more reliable when they appear after a prolonged trend. Understanding these patterns can assist traders in developing successful trading strategies by providing additional insights into the psychology of the market participants.