A forex trading strategy is an approach that a forex trader employs to decide if to buy or sell a currency pair at any given point in time. Forex trading strategies could be based on technical analysis, fundamental analysis, or news-based events.

Forex trading strategies can generate trading signals manually or automatically. In manual systems, a trader sits in front of a computer display, searching for trading signals and deciding whether to buy or sell, while in an automated system, a trader creates an algorithm that finds trading signals and completes trades on its own. These systems, on the other hand, remove human emotion from the equation and may improve performance. As a result, traders should be cautious when buying off-the-shelf forex trading strategies because it is difficult to check their track record and many successful trading systems are kept secret.

This strategy will help you decide which currencies to buy and sell and when to trade. It will also assist you in determining which information is most important in making those decisions. Strategies are frequently built on market signals, and they are effective when certain factors match up to fit your strategy's specific parameters. Some market participants automate these decisions by developing or subscribing to algorithms. Others appreciate the ease of copy trading, which involves making trades in your account based on the moves of other peak forex traders from around the world whom you may want to follow.

Making Your Own Forex Trading Strategy

Many forex traders start with a simple trading strategy, but an effective forex trading strategy consists of several different components which include:

- Market selection: It is essential that traders must be able to identify which currency pairs they will trade and become professionals at reading those currency pairs.

- Position sizing: Traders should always decide how big to make each position in order to control the amount of risk in each individual trade.

- Entry points: Traders must devise rules for when they should enter a long or short position in a specific currency pair.

- Exit points: Traders must create rules that tell them when and how to end a long or short position, as well as the time to exit a losing position.

- Trading strategies: Traders should have established rules for buying and selling currency pairs, which include selecting the appropriate execution technologies. Traders should think about creating trading systems in programs like MetaTrader that allow them to easily automate rule-following, because these applications allow traders to backtest trading strategies to see how they would perform.

When should a trader change strategy?

If a strategy is not proving profitable or delivering the desired results, traders should consider the following before altering their strategy:

- Aligning risk management with trading style: If the risk-reward ratio is not appropriate, it may be time to switch strategies.

- Market conditions change: Because a trading strategy may be dependent on specific market trends, it may become obsolete if those trends change. This could indicate the need for tweaks or modifications.

- Understanding: If a trader does not fully grasp the strategy, there is a good chance it won’t work. Which simply means if a problem arises or a trader does not understand the rules, the strategy’s effectiveness is lost.

While change can be beneficial, changing a forex trading strategy too frequently can be costly. If you change your strategy too frequently, you risk losing out.

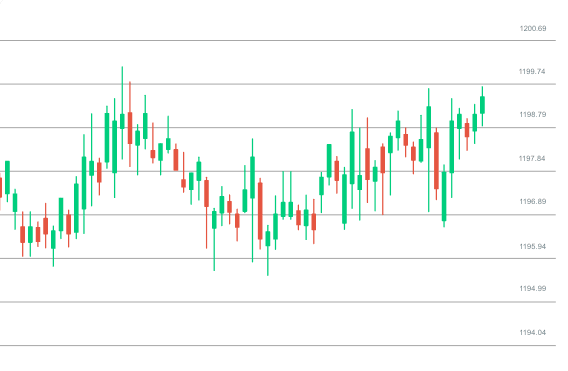

There are numerous Forex trading strategies. However, before you can learn any strategy in depth, you must first learn the fundamentals of reading a price chart. We will therefore discuss two important basic building blocks for making trades in the forex market using technical analysis:

1.Levels of Support and Resistance: As a market rises, support levels are formed. So, if a market is moving lower and then reverses direction and begins moving higher, it has either created or bounced off a pre-existing level of support. As a market falls, resistance levels are formed. So, if a market is moving higher and then reverses direction and begins to move lower, it has either generated a level of resistance or bounced off an existing level of resistance.

Many traders appear to believe that support and resistance levels are absolute and that they would never trade a setup if there was a support or resistance level nearby, which can lead to analysis paralysis and never entering a trade. While it is true that you must consider the market’s key support and resistance levels, you must also consider the overall market condition.

In trending markets, support and resistance levels are frequently broken by the trend momentum; therefore, don’t be worried about support and resistance levels, as they will frequently break. Instead, keep an eye on these rates for trading signals. When a Forex trading signal, such as a price action setup, forms at a key support or resistance level, it is extremely likely to be noticed.

2. Trend trading: Trending markets provide us with the best opportunity to profit because the market is rapidly moving in one general direction; we can then take advantage of this information by looking to enter the market in the direction of the trend, which could lead to an uptrend.

Conclusion

When traders follow the rules, a forex trading strategy works exceptionally well. But, as with anything, one strategy is often not a one-size-fits-all strategy, so what tends to work today may not work tomorrow.

Pingback: Technical Indicators in Analysis

Pingback: Forex Charts; Everything You Need To Know

Pingback: Basic Forex Terms Every Trader Should Know