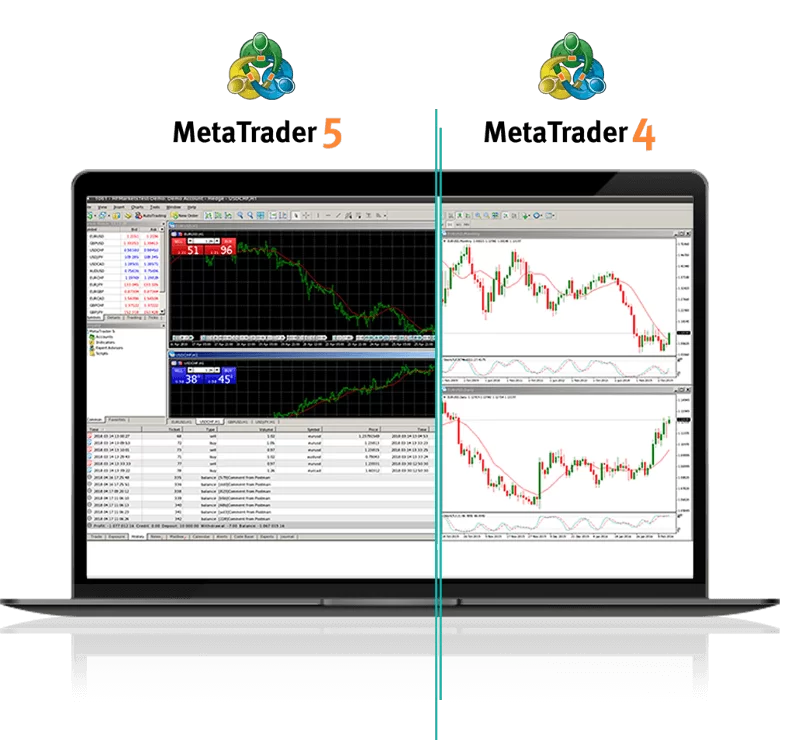

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the world's most widely used trading platforms, both created by MetaQuotes Software Corp. Every day, millions of traders around the world rely on them for superior service. However, it is critical to understand the distinction between MT4 and MT5, as well as which platform is better for forex traders.

MetaTrader 5 employs the MQL5 programming language, as opposed to MetaTrader 4's MQL4. Interestingly, MQL5 is exciting because it enables "black box" coding, which implies it is simpler to program and thus logically will be a good framework for developers and users of trading robots as well as other expert advisors. However, MetaQuotes added this capability to MQL4 in 2014, so there is no longer a distinction between the platforms, though there is a chance that if the language is upgraded in the long term, MetaQuotes will not broaden any upgrades to MQL4 as well as MQL5.

It is important to note that there is no backward compatibility, and the MetaTrader 4 programs will not run on MetaTrader 5. This can be a significant disadvantage for traders looking to "upgrade" and is one of the main reasons why such a change should not be considered an upgrade.

What is MetaTrader 4?

MetaTrader 4 is the most widely used online trading platform among Forex traders. It was introduced in 2005 and provided millions of users with easy access to financial markets. Although MT4 was designed specifically for forex trading, it can also be used to invest in stocks, indices, and commodities via CFDs. MT4 is popular among both novice and experienced traders because it is multi-functional, user-friendly, and enables users to customize the interface to their specific needs. It also provides extensive trading tools that enable traders to implement their preferred trading strategies.

What is MetaTrader 5?

MetaTrader 5 is a trading platform for multiple assets that was launched in 2010. MT5 is better and more efficient than MT4, but this does not replace the previous platform because it is unique and provides more than MT4. MT5 allows users to trade more instruments in nearly every money market, which includes forex, stocks, indices, commodities, and even cryptocurrencies.

MT5 includes all of the tools needed for successful trading, including advanced technological and fundamental analysis, trading signals, algorithmic and copy trading, and trading robots.

The main differences between MT4 and MT5.

1. Instruments for trading: Neither MT4 nor MT5 limit the assets you can trade because it is entirely dependent on the broker with whom you create a trading account. However, using either MT4 or MT5, you can trade all CFDs at FBS. Additionally, forex, metals, energies, forex exotics, stocks, and indices are among the trading instruments available, and the only exception is that cryptocurrencies can only be traded on MT5.

2. Technical indicators: MT4 includes 30 technical indicators; if that is not enough, you can use the free Code Base to install any of the 2000 custom indicators. Furthermore, MT4 provides over 700 paid ones in the market. This is certainly sufficient for market analysis. In comparison, MT5 includes 38 built-in technical indicators for determining market direction. As with MT4, you will have access to a large selection of free custom indicators from the code base as well as thousands of paid indicators from the market.

3. Charting tools: To forecast future price movements, MT4 includes 31 graphical objects such as boundaries, paths, the Gann and Fibonacci tools, shapes, and arrows, while MT5 includes 44 graphical objects for drawing, including geometric shapes, channels, the Gann, Fibonacci, and Elliott tools, and more.

4. Timeframes: There are only 9 timeframes available in MT4: minute (M1, M5, M15, M30), hourly (H1, H4), daily (D1), weekly (W1), and monthly (MN). It may not appear to be much when compared to MT5, but these indicators are sufficient for swing and long-term traders. MT5 has 21 timeframes: minute (M1), hourly (H1), daily (D1), weekly (W1), and monthly (M10) (MN). A large selection allows traders to conduct in-depth analyses of their favorite assets.

5. Trading orders: There are four types of orders available in MT4: buy stop, buy limit, sell stop, and sell limit. In contrast to MT4, MT5 offers six types of pending orders: those offered by MT4 plus two more buy-stop limits and sell-stop limits.

6. Economic Calendar: MT4 does not include an economic calendar. However, you can easily keep track of relevant financial news by using a third-party calendar. FBS, for example, has its own Economic Calendar to track macroeconomic events that affect the markets. MT5 includes an economic calendar that provides important and actual information about macroeconomic events. It assists traders in keeping track of important financial announcements that may affect the price of assets. If you want to better plan your trading, you must use the economic calendar.

7. Demo trading: Demo trading is supported by both MT4 and MT5. This means you can practice trading in real-world market conditions without fear of losing money. All you have to do is create a free demo account. It works in the same way as a real account, except you trade with virtual money rather than real money. A demo account is an ideal way for any new trader to test the MT4 or MT5 platform and trading tools.

8. Usability and mobility: The MT4 and MT5 platforms are available in different configurations: desktop, mobile, and browser. Windows, macOS, and Linux on the desktop; Android and iOS on mobile; and Mozilla Firefox, Google Chrome, Apple Safari, Microsoft Edge, Opera, and Internet Explorer are the browsers supported.

In terms of design and usability, MT4 and MT5 are very similar. The main menu has changed slightly, but the most frequently used features have not. You can tailor the interfaces to your specific trading requirements. To use these platforms, all you need is an internet connection.

Pros of MT4

1. MT4 is ideal for beginning brokers simply because it is simpler and easier to use than MT5.

Cons of MT4

1. MT4 has fewer trading options than MT5, and it is slightly slower than MT5.

Pros of MT5

1. MT5 allows you to trade forex, stocks, indices, commodities, and cryptocurrencies.

2. More charting tools, technical indicators, and timeframes are available in MT5 than in MT4.

Cons of MT5

1. For beginners, MT5 may appear to be a more complex platform.

Whether you use MT4 or MT5, you will need a trustworthy broker like FBS because forex traders can select their preferred trading platform. However, this option is linked to the choice of Forex broker because not every broker offers every type of trading platform. Furthermore, some brokers do not have true compatibility with specific Forex trading platforms but instead provide access to them via a bridge, which is a piece of software that connects a Forex broker's dealing system with the platform. This can work satisfactorily, but if the bridge fails or is slow, it can have a negative impact on trade execution and management.

Conclusion

MetaTrader 5 has two significant programming-related benefits over MetaTrader 4. For starters, it has Backtesting functions that allow you to test programmed trading strategies at a much faster rate, which can save time if you are the type of trader who needs to run a large number of backtests. It also supports multi-currency pair back testing at the same time. This can significantly accelerate Backtesting procedures.

READ ALSO: Introduction to MetaTrader

Pingback: Downloading And Installing MetaTrader4